Your product’s value to the customer is your benefit-to-cost ratio, also known as return on investment (ROI). Whenever you can provide more benefit through your product, or provide your product at lower cost, you make your product more attractive to prospective new customers and to existing customers.

Most product managers are aware of how to increase the benefit their product provides, but few consider the cost component of their value proposition. One of the most significant costs associated with products is the switching cost, also known as adoption cost.

In this article, we’ll dive deep into the definition of switching cost, and the different flavors of switching costs. Then in our next article, we’ll create a framework around switching costs to enable you to drive a stronger value proposition through your product.

Switching Cost Definition

Let’s define switching cost as “the time, money, effort, and emotional cost associated with switching usage from one product to another.”

Whenever you switch from one product to another, you must pay these costs. Of course, the less cost you have to pay to switch, the easier it is for you to justify switching.

For example, not many people like switching from Android smartphones to iPhones, or from iPhones to Android smartphones. According to this March 2018 study by Consumer Intelligence Research Partners, only 9% of Android users switch away from Android, and only 12% of users switch away from iOS.

That’s because they have to incur multiple kinds of switching costs to move from Android to iPhone, or from iPhone to Android. In fact, Wikipedia neatly classifies switching costs into 3 kinds:

- Financial switching costs

- Procedural switching costs

- Relational switching costs

I’ll dive into each of the three kinds of switching costs below. As you read, consider how each one impacts the stickiness of users to either Android or iOS. As a side note, these categories are not mutually exclusive; the most impactful switching costs are the ones that fall across all three categories.

Financial Switching Costs

Whenever you switch from one product to another, the most obvious cost that you incur is the financial switching cost – that is, the monetary value that you have to pay for the new product, and the monetary value that you lose when you stop using the old one.

For example, annual subscriptions impose financial switching costs.

Say you’re using a language learning product like Duolingo, and you’ve signed up for a 1 year subscription with them. When you attempt to switch to a different one like Busuu, you forfeit the remainder of your Duolingo subscription, which makes it less likely for you to switch to Busuu until the end of your subscription with Duolingo.

Another example to consider is rewards points.

When you use the Starbucks app, you gather points towards your next coffee. If you switch away from Starbucks and towards Philz Coffee, you cannot use your Starbucks points with Philz. You essentially forfeit all of those Starbucks points, which makes it less likely for you to want to switch away.

Yet another example to consider is the time cost associated with switching products, which is an implied financial cost.

For example, consider switching CRMs from Salesforce to Microsoft Dynamics, or the other way around. It takes a lot of time to migrate all of your existing data into a new system. Time is money – and so this needed setup time is a financial switching cost.

Procedural Switching Costs

Procedural switching costs are less obvious but are immensely more tangible to the user when it comes to changing products.

For example, let’s talk about using Google Chrome vs. Mozilla Firefox. Both products are entirely free, and therefore there are no financial switching costs associated with either one. If you only accounted for financial switching costs, you’d be confused as to why users don’t switch between then more often.

But then, think about how different they are when it comes to interfaces and user interactions.

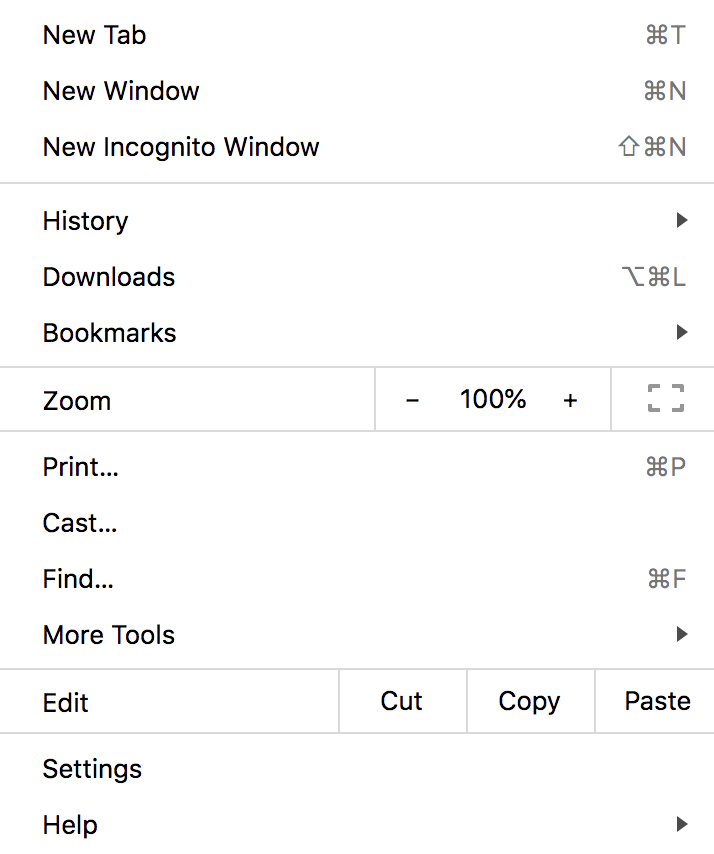

Here’s the Chrome menu on a Mac:

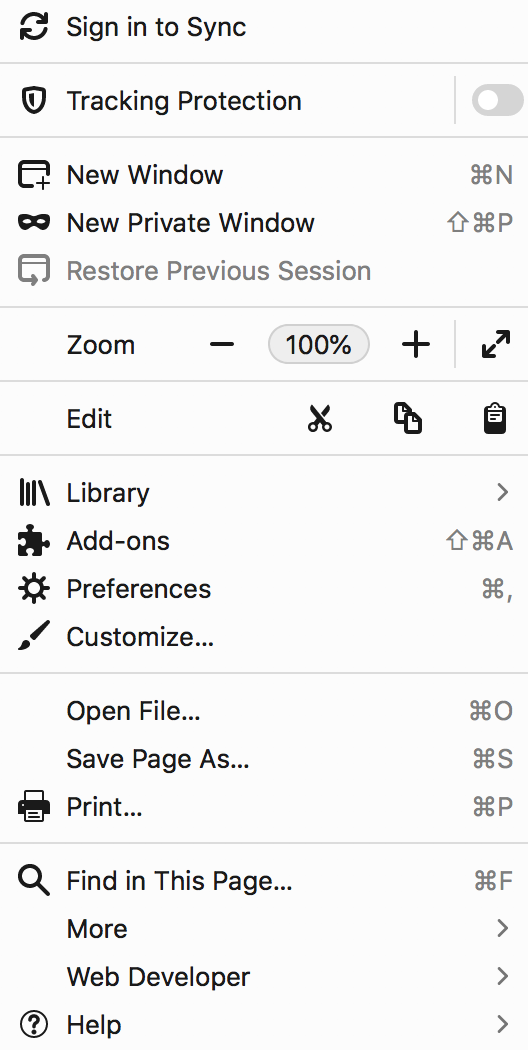

Here’s the Firefox menu on a Mac:

For example, in Chrome, “Settings” is at the bottom of the menu, whereas its counterpart in Firefox is called “Preferences” and sits in the middle of the menu.

While this is just a minor difference, it means that any user who tries to use Firefox right after using Chrome needs to spend mental energy to reorient herself. And of course, the reverse is true: any user who tries to use Chrome right after using Firefox also needs to spend mental energy to orient herself. Plus, these minor differences start to add up – Chrome and Firefox have different keyboard shortcuts, for example.

Procedural switching costs are even more dramatic in B2B products, where there are entire processes built around the usage of a particular product.

When a business adopts a new product, it needs to train its employees on how to use the new product, and it needs to ensure that employees stop using the old product.

Furthermore, the business needs to have a clear sense of which new use cases have been unlocked and therefore need support, and which previously supported use cases are no longer available and therefore also need support.

These training costs and support costs are all part of procedural switching costs.

Relational Switching Costs

Relational switching costs can be split into two different kinds: the relationships you lose when you move from one product to another, and the identity change you must make when you affiliate yourself with a different brand.

When you switch your personal networking usage from Facebook to Google Plus, for example, you immediately lose every single one of your relationships on Facebook. Humans are inherently social animals, and we fear losing our relationships – that explains why people stick to whatever social media platform they started with.

This same dynamic is even more explicitly clear when you consider switching from LinkedIn to a different professional network, such as Jobcase. You don’t want to deal with that data loss, so you don’t make the switch.

There’s also an identity cost that you pay when you move from one product to another. For example, consider the dating app Tinder versus the dating app Coffee Meets Bagel. Both have very particular brands. When you switch products, you are also changing your identity. That change in identity creates psychological pain and friction.

Identity costs are correlated with brand loyalty and brand strength. Using non-tech examples, think about Pepsi versus Coke, or McDonald’s versus Burger King.

You can find a similar identity change cost when you think about Uber users versus Lyft users. While both ridesharing companies have faced challenges and had successes, and while both companies have similar interfaces, similar use cases, and similar pricing, people split themselves into either Uber users or Lyft users.

Summary

The value that your product provides is the ratio of its benefits versus its costs.

Switching costs are one of the major costs associated with any product. In fact, there are 3 major types: financial, procedural, and relational switching costs.

In your daily life as a user of multiple products, consider how switching costs repeatedly prevent you from switching to other products.

Now that we’ve set up a solid foundation for analyzing switching costs, in our next article we’ll discuss how to craft product strategies to leverage switching cost to our advantage.

Have thoughts that you’d like to contribute around switching costs? Chat with other product managers around the world in our PMHQ Community!

Join 30,000+ Product People and Get a Free Copy of The PM Handbook and our Weekly Product Reads Newsletter

Subscribe to get:

- A free copy of the PM Handbook (60-page handbook featuring in-depth interviews with product managers at Google, Facebook, Twitter, and more)

- Weekly Product Reads (curated newsletter of weekly top product reads)

Clement Kao has published 60+ product management best practice articles at Product Manager HQ (PMHQ). Furthermore, he provides product management advice within the PMHQ Slack community, which serves 8,000+ members. Clement also curates the weekly PMHQ newsletter, serving 27,000+ subscribers.